Both Locke and the Carolina Journal in the last couple of days have highlighted work by the Tax Foundation highlighting ways North Carolina could continue its pro-growth tax reform.

We’ve documented North Carolina’s decade of success following historic tax reforms in 2013, and recent data presents still more evidence.

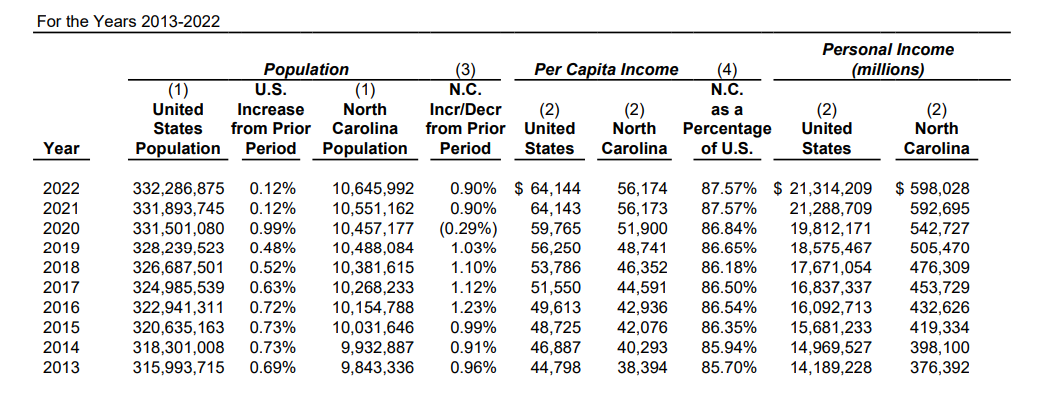

The chart below is from North Carolina’s 2022 Comprehensive Annual Financial Report (CAFR) produced by the State Controller’s office. It shows how, since 2013, North Carolina’s per capita income has been growing at a faster rate than the national average.

You will notice from the middle columns that in 2013, North Carolina’s per capita income was just 85.7% of the national average. By 2021, it had grown to 87.57%, indicating that Tar Heel state workers’ wages were rising faster than the national average.

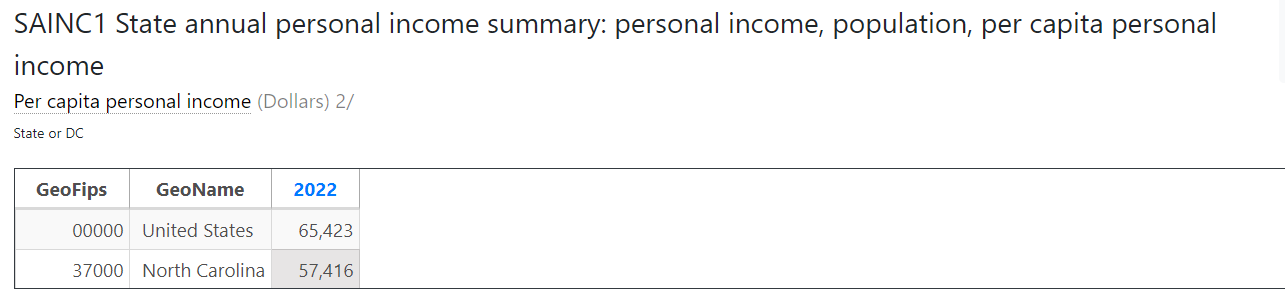

Also note that the 2022 data included in the CAFR is just an estimate, but we can get updated 2022 info from the Bureau of Economic Analysis, which shows that last year North Carolina’s per capita income rose still further to 87.76% of the national average, a full two percentage points higher than in 2013.

Tax reform has North Carolina’s economy trending in the right direction, and there’s room for still more improvements. North Carolina’s workers will benefit.