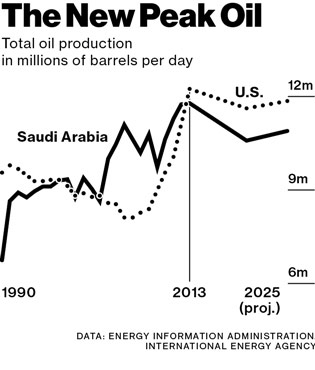

An article in the latest Bloomberg Businessweek labeling the U.S. the “Petro States of America” includes the chart you see to your right. One wonders whether the “new” peak oil carries more validity than the “old” peak oil.

An article in the latest Bloomberg Businessweek labeling the U.S. the “Petro States of America” includes the chart you see to your right. One wonders whether the “new” peak oil carries more validity than the “old” peak oil.

As James Delingpole wrote a couple years ago about the fallacy propping up projections of peak oil:

[S]o much dangerous political nonsense — especially in the environmental movement — depends on it. If you believe, as peak-oil theorists do, that global oil reserves are about to run out, then clearly it makes more sense to go down the road many greens have long been urging us to take: Rein in energy consumption; tax fossil fuels; encourage renewables; ration air-conditioning and hot showers; deindustrialize. But Yergin demonstrates clearly and unequivocally that peak oil is a sham. … Yergin runs the figures, and they are amazing: In 2009, for example, after a year’s worth of oil production at around 90 million barrels per day, the world’s proved oil reserves were greater at the end of the year (1.5 trillion barrels) than they were at the beginning.

This sounds like an impossibility. But such is the sophistication of the energy industry. Today it is worth $65 trillion, and in two decades it will be worth $130 trillion — more than enough incentive for entrepreneurs, scientists, and big business to develop increasingly imaginative ways of locating and exploiting the world’s resources. In the case of oil, this means learning how to drill in more hostile terrain, such as the deep-ocean sites off the coast of Brazil and in the Gulf of Mexico. In the case of “unconventional” fossil fuels, it means developing technologies like “fracking” — the drilling process that has suddenly made available trillions of cubic feet of hitherto inaccessible shale gas.