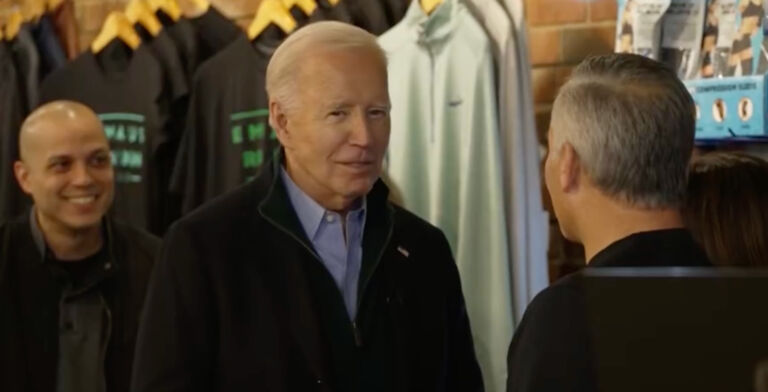

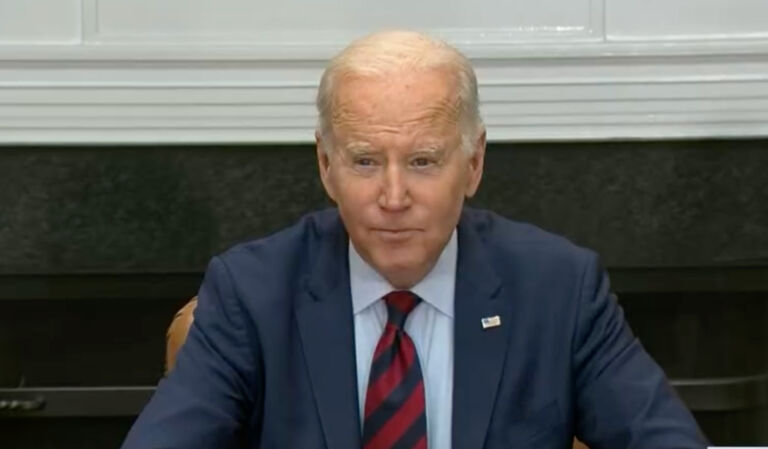

My latest column published by the American Institute for Economic Research exposes how a provision in Pres. Biden’s misnamed Inflation Reduction Act will harm the economy and potentially make inflation worse.

To qualify for the act’s tax credit of up to $7,500 on the purchase of an electric vehicle (EV), the vehicle’s battery must be made of minerals and components mostly extracted and produced in America, or otherwise in a country with which the U.S. has an explicit free trade agreement. This provision excludes the output of many countries, including those in Europe, which can mine and produce the needed minerals and components at lower costs than American companies can. …

Inefficient companies are protected from competition by political favoritism, at the expense of consumers and other domestic companies handicapped by government interference. An economy hampered by protectionism is less efficient, and the increased scarcity due to diminished output causes prices to be higher than they otherwise would be. …

Moreover, the most likely response from EV sellers will be to raise their prices in response to the tax credit offered to their customers. Say a dealer discovers that a customer is willing to pay $50,000 for an EV. Knowing the customer is eligible for a credit of $7,500, the dealer will raise the price to $57,500.

The EV dealers and manufacturers will get to pocket the extra $7,500, in a classic example of political power-dynamics in which the party in charge rewards their donor class through payouts at the public’s expense.