- In addition to the $30 billion of General Fund spending in the 2023 budget, the General Assembly also appropriated over $7 billion that’s hardly being reported

- Setting aside money in reserve funds is a way for the state to look like it’s spending significantly less than it is

- This practice is relatively new: of 30 active reserves, 20 have been created since 2020

Back in October, my colleague Brian Balfour pointed out something curious with the 2023–24 North Carolina state budget: there’s over $7 billion in the budget being completely overlooked. When most of the media discussed the state spending plan, they referred to a $30 billion budget. For example, see these headlines: “North Carolina legislature passes $30 billion budget,” “North Carolina Legislature Passes $30 Billion Spending Plan,” and “Republicans release long-awaited $30 billion NC budget with raises and tax cuts.” But that $30 billion number only tells part of the story.

The oft-repeated $30 billion is exclusively General Fund spending, the primary means of financing state government operations. However, there’s more than $7 billion in other allocations not getting any coverage. The General Assembly actually set aside about $37 billion, but that $7 billion in allocations above the reported $30 billion is in the form of budgetary “reserves” being set aside from state revenue. Essentially, the state is allocating that $7 billion to special accounts set up as reserves for future use, but significant portions of it are allocated right away.

These allocations may seem rather innocuous and a function of good budgeting; after all, shouldn’t we all be setting aside money for a rainy day?

But the truth is much more complicated than that. In fact, North Carolina does have a specifically dedicated “Rainy Day Fund” and has for over three decades. It is certainly a laudable achievement that, as of September 2023, the state’s Savings Reserve reached $4.75 billion, and this method of setting money aside for future emergencies should continue.

However, this function of good budgeting becomes much more doubtful when the most recent budget has fourteen different reserves with uses varying from legitimate savings to simply appropriations with extra steps.

Reserves now make up nearly a quarter of the General Fund spending.

For fiscal year (FY) 2023–24, a total of $7,223,192,500 is set as “Reservations of Revenue,” which means that there is $7.2 billion in revenue not “available” for appropriation within the General Fund. So when the $30 billion budget is mentioned, it refers only to General Fund spending, which is money that is available to be spent after the $7.2 billion is set aside.

Some of the reserves make sense — again, the Savings Reserve (Rainy Day Fund) is one of those, and it is a prudent and necessary reserve to have. However, there are others that appear to be almost entirely appropriations of funds themselves that make little sense as reserves. For example, the Retiree Supplement Reserve has $146 million allocated to it for FY 2023–24, but it doesn’t appear to be a reserve in the true accounting sense at all — it is an allocation of money to increase retiree benefits by 4%. This seems like a perfectly reasonable appropriation, but it obscures real state spending when this $146 million is not being shown as General Fund spending and is instead a separate reservation.

The Housing Reserve is a similar program, in which $45 million is reserved to be given to the Housing Finance Agency and the Dare County Affordable Housing Project. Again, the legitimacy of these appropriations is not being questioned, but it is another $45 million being set aside as a reserve instead of being included with General Fund spending.

There are a total of 30 active reserves, 20 of which have been created since 2020.

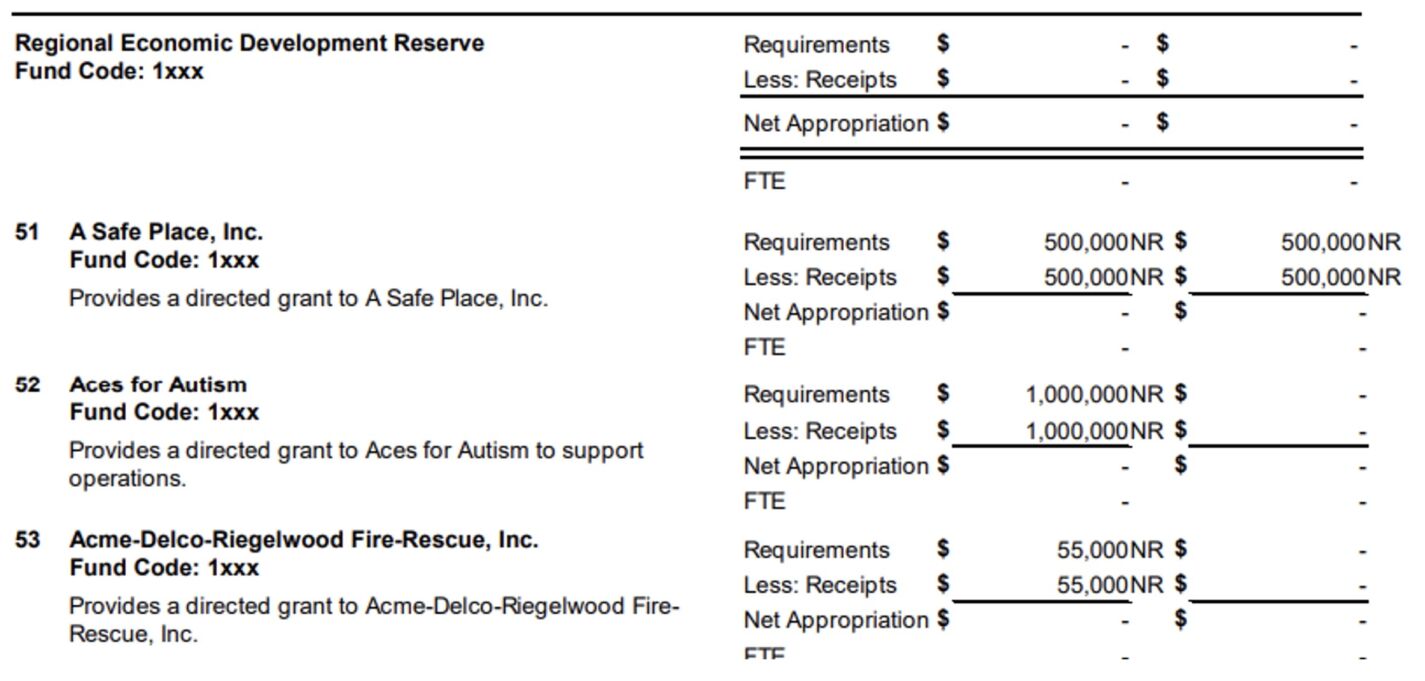

The other troubling aspect of this practice is that the accounting for it can obscure how the budget is actually supported. The below capture from the $1.25 billion Regional Economic Development Reserve illustrates the concern.

It’s a shell game obscuring the true amount of state spending. Budget writers set aside millions into a “reserve,” then spend the money from the reserve. But those expenditures don’t count against the General Fund’s total appropriations because they are instead itemized as “receipt-supported” expenditures, even though the “receipts” are merely from the money that was just set aside into the reserve.

We’re unsure as to why legislators are muddying the budget in this way. By reserving this money it stays separate from the General Fund appropriations — perhaps it is intentional in an effort to “allow” lawmakers to claim that their General Fund spending growth is lower than reality. Such measures can disguise the fact that actual spending has continued to balloon and that reserves now make up nearly a quarter of the General Fund spending.

Finally, perhaps most troubling of all, is the speed with which this has become a practice for the General Assembly. For FY 2023–24, there are fourteen different budget reservations totaling $7.2 billion. For FY 2021-22, there were eleven reservations totaling $6.3 billion. For FY 2018–19, there were only two reserves totaling just under $300 million: the Savings Reserve and the Medicaid Transformation Reserve. This has been a rapidly changing — and largely unprecedented — budgeting procedure. Indeed, as recently as a handful of years ago it was common practice for contributions to special “reserve” funds to be included in the General Fund appropriations.

In fact, there are a total of 30 active reserves, 20 of which have been created since 2020.

With state budgeting, transparency is of utmost importance. Constituents of all backgrounds should be able generally to follow what is being put forth. These reserves are muddying the waters, creating confusion in understanding the full picture of the state’s budget allocations. Maybe the reason for it is benign, but given the information we have now, that remains to be seen. Perhaps the legislature could explain the purpose in greater detail, at least for the sake of transparency.