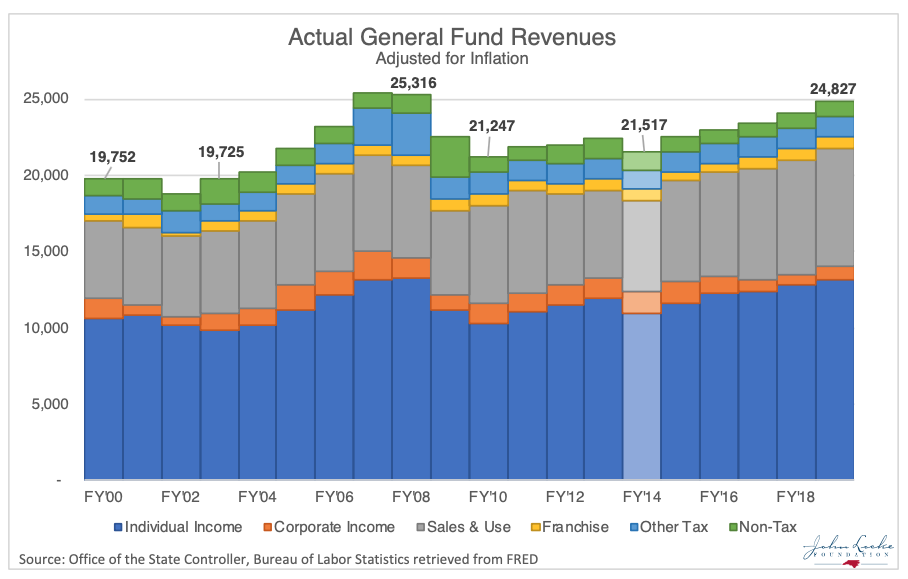

In this research update, I take a closer look at revenues and expenditures in North Carolina over the past 20 years. I use actual collections and expenditures from the Office of the State Controller’s year-end General Fund Monthly Financial Reports. I adjust for inflation using the average inflation for the year prior to the start of the fiscal year, which means the consumer price index in 2017 is the baseline for Fiscal Year (FY) 2018-19.

First, we notice how much revenues from personal income tax and corporate income tax fluctuate from year to year. Between FY 2002-03 and FY 2007-08, personal income tax revenues climbed 35 percent from $9.8 billion to $13.3 billion. Corporate income tax collections adjust more rapidly – from a low of $583 million in FY 2001-02 to a peak of $1.8 billion in FY 2006-07, a 213 percent increase.

North Carolina had three years of higher tax revenues before the FY 20013-14 tax reform, which reduced personal income tax revenue $969 million and total revenue $870 million. Sales tax revenue has grown from a post-recession low of $5.8 billion in FY 2012-13 to $7.8 billion in FY 2018-19 and from 26 percent of total tax revenue to 31 percent. Tax changes since then have not outpaced revenue gains from an improved economy, though revenues still have not reached the inflation-adjusted peak of $25.3 billion in FY 2006-07 and FY 2007-08.

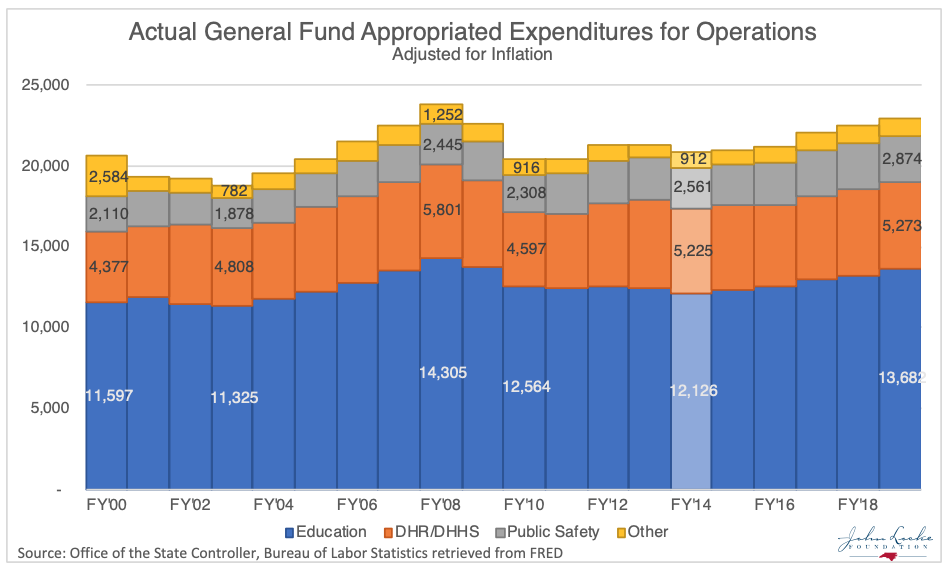

General Fund operating appropriations are almost used to support public education, Medicaid (health and human services), and prisons (public safety). Spending in all areas grew rapidly between the FY 2002-03 trough of $18.8 billion and the FY 2007-08 peak of $23.8 billion, which was an inflation-adjusted $1.2 billion higher than the year before or the year after. It remains $843 million more than in FY 2018-19 adjusted for inflation. Bottom quickly reached in FY 2009-10 and FY 2010-11, as education spending fell $1.7 billion and health and human services spending fell $1.2 billion. Both were offset by temporary federal stimulus spending.

As the economy recovered, Medicaid spending crowded out other areas as it grew $628 million from $4.6 billion to $5.2 billion. Over that time, education spending dipped another $442 million. State spending on public safety managed to grow 11 percent, from $2.31 billion to $2.56 billion by FY 2013-14. In the following five years, education spending rebounded an inflation-adjusted $1.5 billion to $13.7 billion. Total health and human services spending remained relatively flat, even though Medicaid enrollment and spending continued to grow. Public safety spending also increased by 12 percent to $2.9 billion.

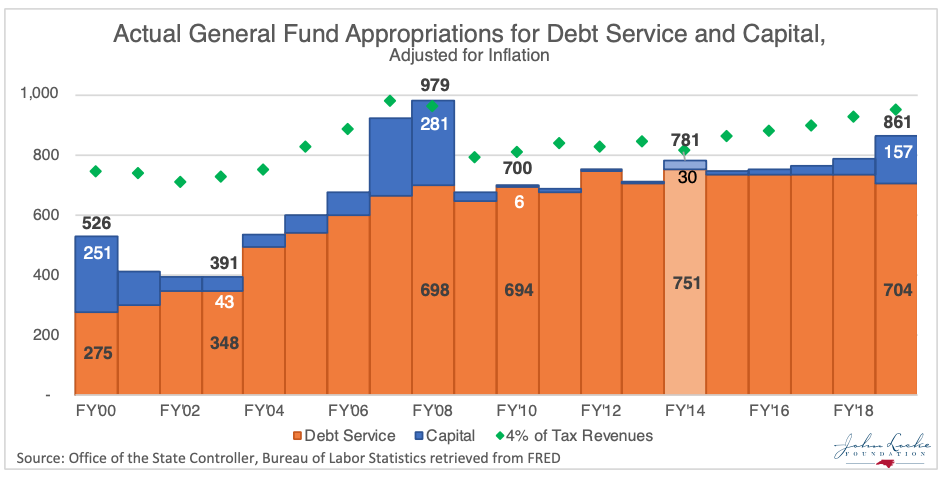

Debt service payments doubled between FY 2002-03 and FY2007-08, after adjusting for inflation, from $348 billion to $698 billion. University and community college bonds were part of the increase, but non-voter approved debt contributed its share as well. From FY 2002-03 to FY 2007-08, the General Assembly took on millions of dollars in certificates of participation (COPs) and limited obligation bonds. Since the start of the recession, the only new General Fund debt has been the Connect NC bonds passed in 2016.

Capital investments from current dollars have rarely amounted to much. The recently created State Capital and Infrastructure Fund dedicates 4 percent of tax revenues plus one-fourth of any unreserved cash balance to debt service, construction, and repairs and renovations of state facilities. If the state had invested in its facilities at a similar rate before the recession, it would not have the current backlog of needed improvements.