- Over the last decade, state legislators held government growth to the rate of growth in inflation and population even while increasing spending on teacher pay and Medicaid

- Their restraint made room for rainy-day savings, tax reductions, and economic growth

- A constitutional Taxpayer Bill of Rights would preserve North Carolina’s positive momentum

A constitutional Taxpayer Bill of Rights would preserve North Carolina’s positive momentum of the past decade. Legislators have been budgeting on the same principles since 2011, so adding it to the constitution would merely hold future legislatures to the same standard.

Since 2011, North Carolina legislators have kept government growth in check even as they increased spending on teacher pay and Medicaid. They have cut taxes and built up healthy reserves to get through natural disasters and economic recessions. People and jobs have come to North Carolina in response leading to faster economic growth.

Spending held in check since the Great Recession

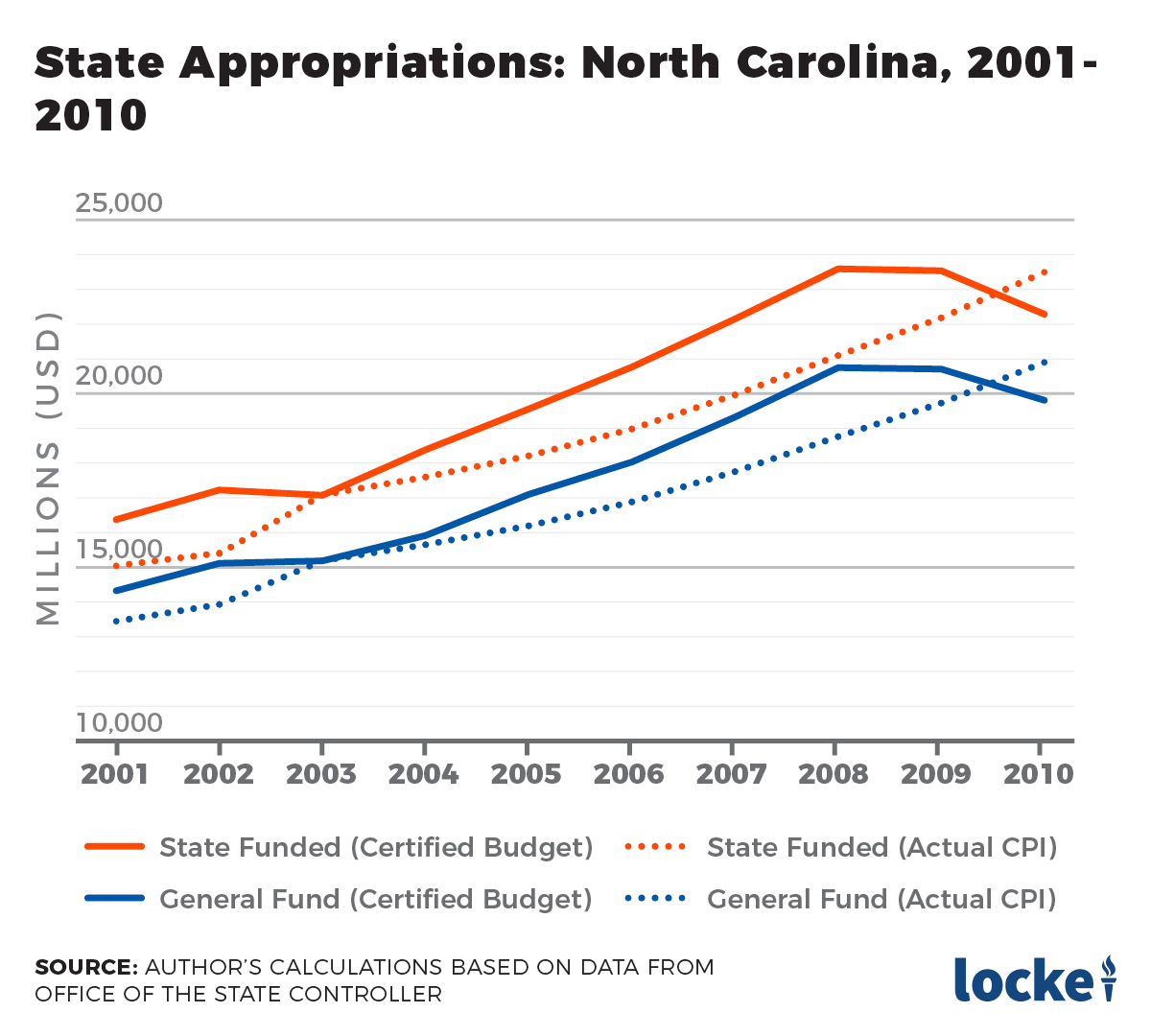

The decade of 2011–20 started with lingering effects of the financial crisis and Great Recession. Nevertheless, the contrast in spending between that decade and the previous decade of 2001–10 is stark, as can be seen in the graphs below. For 2001–10, state spending bottomed out in 2003 from the tech bubble collapse and 9/11 attacks. From there, spending grew faster than inflation and population growth until the recession. Democratic legislators and Gov. Mike Easley passed and kept “temporary” tax increases in place for much of the period and did not set money aside in the state’s rainy-day fund, the Savings Reserve. It culminated in Gov. Bev Perdue’s temporary tax increases in 2009, even as spending eventually fell below the rate of inflation and population.

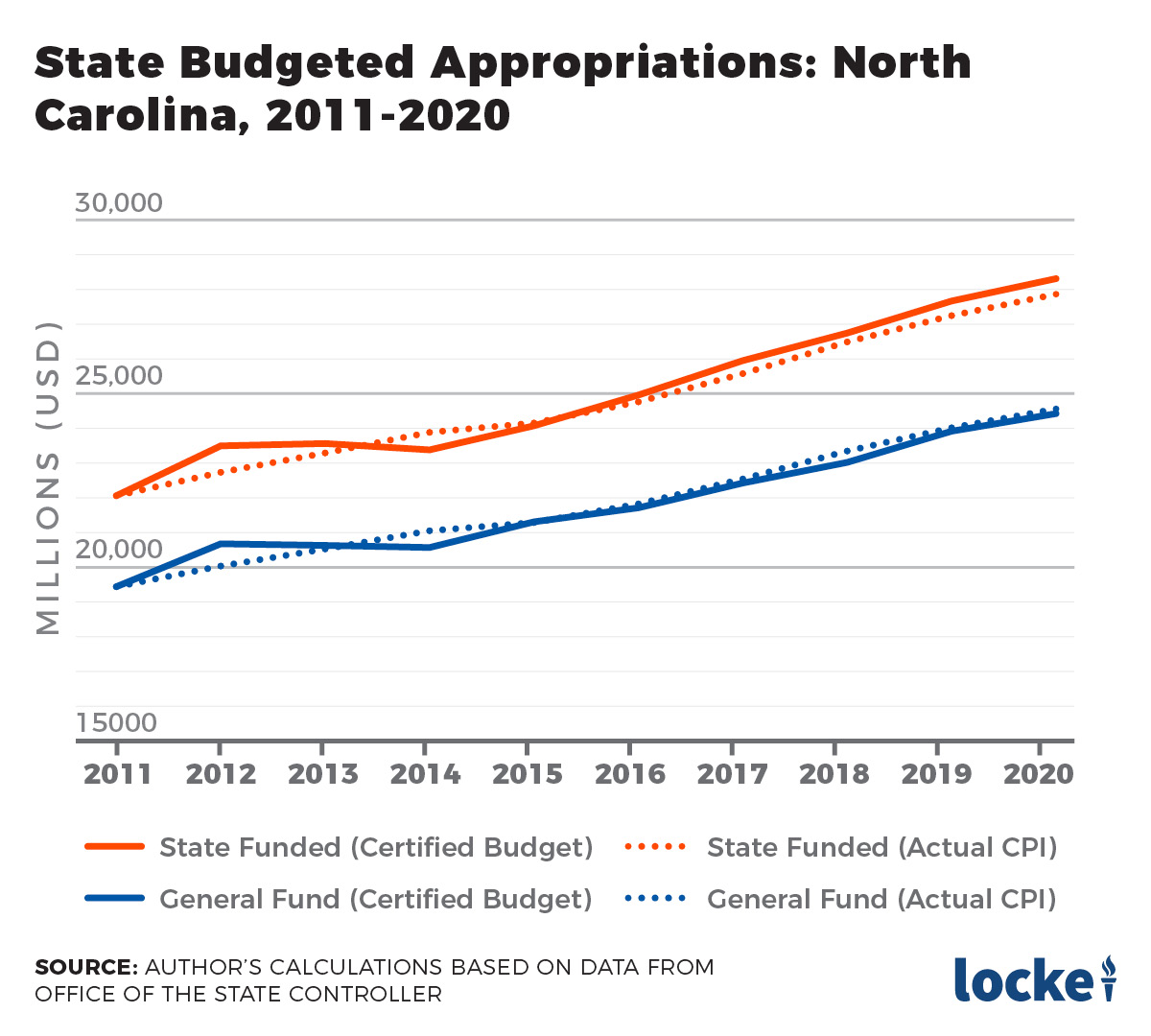

Since 2011, however, Republican legislators kept spending roughly in sync with population and inflation until the veto fight during Fiscal Year (FY) 2019-20 resulted in flat spending.

The following graphs compare budgeted appropriations with appropriations if they had grown no faster than inflation and population, as they would under a Taxpayer Bill of Rights. The solid blue lines show the actual, budgeted spending for each year. The dotted blue lines represent General Fund appropriations if they grew with population and inflation (from the trough in 2003 in the first graph and from 2011 in the second). The orange lines add state transportation spending from the Highway Fund and Highway Trust Fund.

Spending prior to FY 2001-02 had been growing faster than inflation and population. The recession led to a net reduction in budgeted appropriations, even with “temporary tax cuts.” Budgeted appropriations then accelerated through FY 2007-08, when the recession hit state coffers and spending again dipped below the rate of inflation and population despite another round of “temporary” tax hikes.

From the low in FY 2010-11, budgeted appropriations have grown at the same rate as the combined increase in inflation and population. Appropriations did not fall and the state did not raise taxes.

Teacher pay increases, Medicaid maintenance, and other priorities

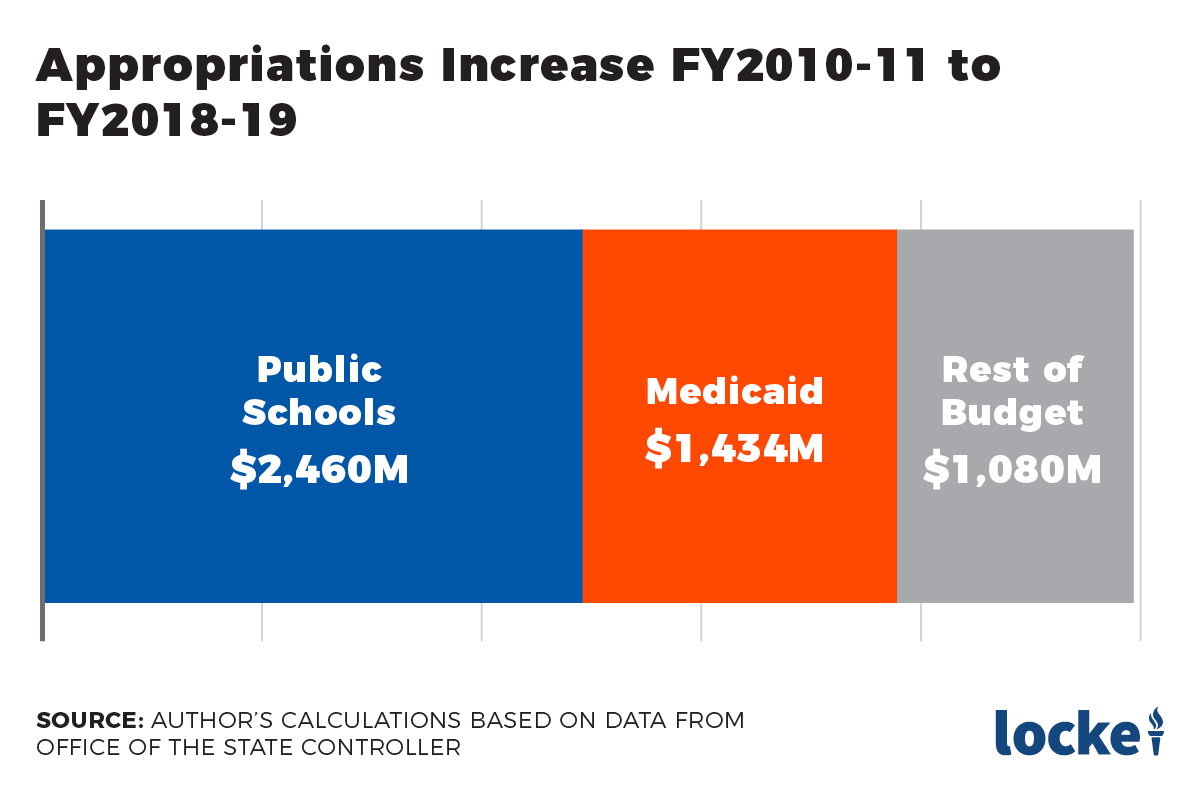

Despite their fiscal restraint, legislators have prioritized higher spending on public schools and Medicaid over the past decade. State spending on Medicaid climbed 61 percent, from $2.4 billion to $3.8 billion, between FY 2010-11 and FY 2018-19 as legislators paid current expenses. In addition, the legislature has built $344 million in reserves to ensure Medicaid can continue to meet its budget and transition to managed care.

Average teacher salaries climbed more than 25 percent between FY 2010-11 and FY 2018-19, before the budget veto standoff and Covid-19 kept teacher salaries from being increased further, which would have been by 3.9 percent or more over the current biennium. Teacher pay increases helped boost state appropriations on education by $2.5 billion.

Together, Medicaid and K-12 schools accounted for 78 percent of the $5 billion increase in state appropriations from FY 2010-11 to FY 2018-19 (see the graph below). Taxpayer Bill of Rights spending restraints can serve to dampen excess government spending while allowing priorities to continue to receive ample funding.

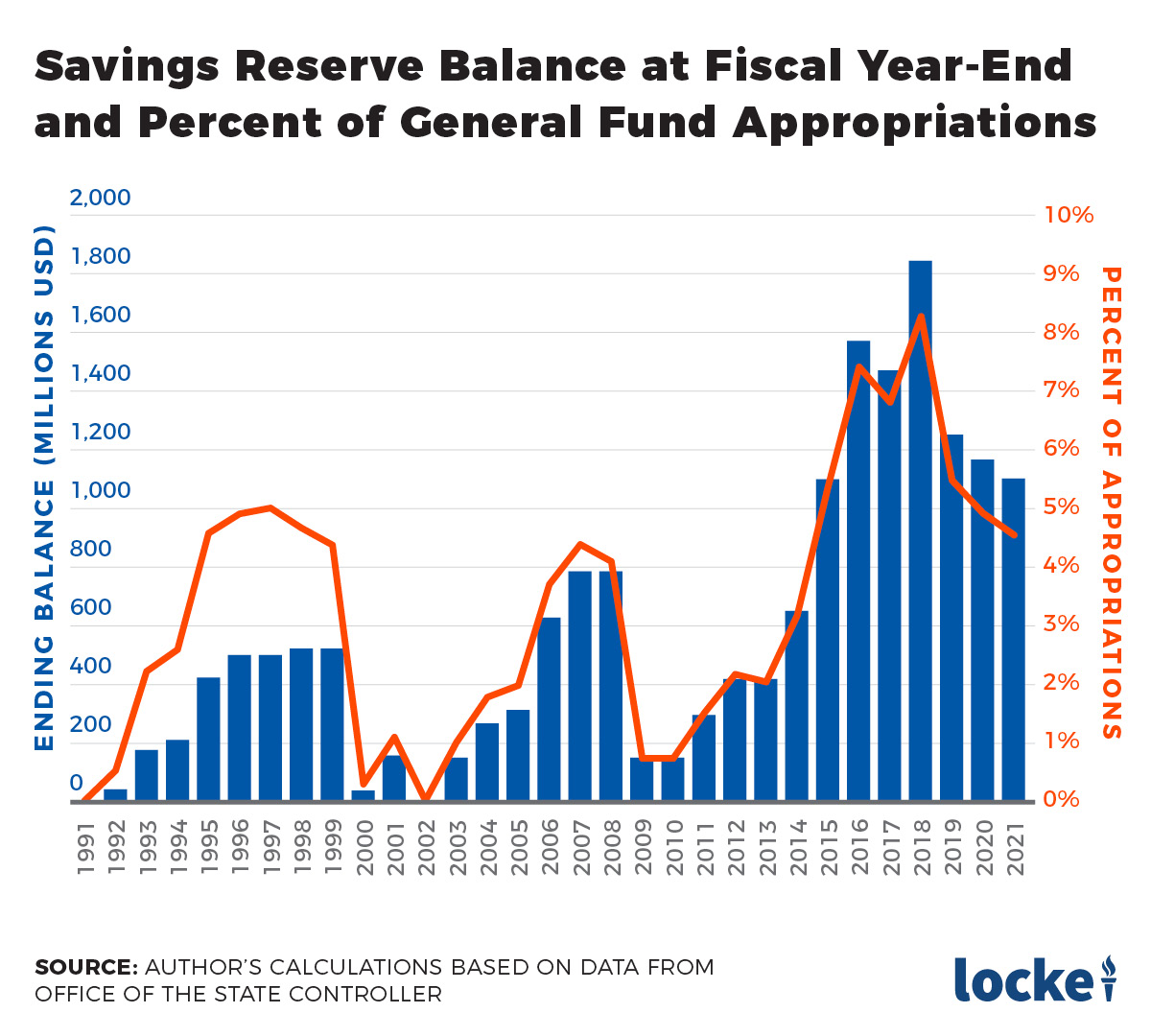

Savings reached $2 billion and are still high at $1.1 billion

Restrained and prioritized spending gave legislators room to start saving again to prepare for the next recession and provide assistance in the wake of hurricanes or other storms. The Savings Reserve had reached a low of $150 million in FY 2009-10, but the General Assembly made deposits to the reserve in seven of the next nine years. State rainy-day funds briefly surpassed $2 billion in 2018 before Hurricane Florence and winter storms brought the balance down to $1.2 billion heading into the Covid pandemic. Even so, at 4.9 percent of General Fund appropriations, the Savings Reserve was in better condition in March 2020 than at any year prior to FY 2014-15 except for FY 1996-97, as the following graph shows.

Tax reforms have saved taxpayers billions of dollars

Taxpayers have benefited from tax rate reductions since 2011. The first one was when the General Assembly kept the scheduled expiration of a one-cent, temporary sales tax increase that had been enacted in 2009, despite Gov. Bev Perdue’s desire to make 0.75 cents of it permanent. Completely eliminating the temporary tax saved North Carolinians $750 million annually, compared with Perdue’s plan. We do not know how long that temporary tax increase would have been extended, but a temporary half-cent increase in 2001 remained in effect until 2006, after which 0.25 cents of it became permanent.

Since 2013, legislators have enacted corporate and individual income tax reductions. With the most recent reductions, corporate rates have fallen from 6.9 percent in 2013 to 2.5 percent now. Individual tax rates have fallen from a progressive, 6 percent to 7.75 percent rate with a standard deduction for single filers of $3,000 ($6,000 for married filing jointly) in 2013 to a flat, 5.25 percent rate with a standard deduction of $10,750 ($21,500 for married filing jointly) now.

Taxpayers save roughly $2.5 billion per year thanks to these reforms.

Lower rates have also reduced the desire to provide targeted exemptions from the tax code. The 91 corporate and individual income tax expenditures worth more than $5.3 billion in FY 2011-12 fell to 51 tax expenditures worth $2.9 billion in FY 2020-21.

Simpler, lower taxes have improved North Carolina’s standing on the Tax Foundation’s annual State Business Tax Climate Index from 46th in 2011 to 10th in 2021. Without spending restraint, such improvements in the tax code would not have been sustainable.

Employment and economic output accelerated

Economic theory suggests lower spending should be better for economic growth as well. Milton Friedman said spending is the real tax, so the best way to know future taxes would be to look at current spending including debt. Harvard economist Alberto Alesina found that better economic growth followed when governments balanced their budgets with lower spending instead of higher taxes.

From the bottom of the recession in 2009 through 2013, North Carolina’s economy grew at half the rate of the nation as a whole (1.0 percent average annual real GDP growth in NC vs. 2.1 percent nationally). Spending restraint and tax reforms have brought the state (2.3 percent) closer to the national average (2.5 percent). From 2009 through 2013, private-sector employment grew an average 1.3 percent per year in North Carolina and nationally. From 2013 to 2019, however, North Carolina has outpaced the national average of 1.9 percent growth with 2.4 percent annual job growth.

North Carolina also has attracted more residents from other states, ranking sixth on this measure in 2020.

Fiscally prepared for the pandemic

One small but significant institutional change helped preserve the economic and other benefits of the past decade’s fiscal restraint. In 2016, legislators added a provision to continue operations under the previous year’s budget if a new budget had not passed by the start of a fiscal year. Despite Gov. Roy Cooper’s veto of the legislatively passed budget bill in 2019, there was never a threat of government shutting down, which reduced his ability to demand unaffordable expansions of government. By keeping appropriations relatively flat even as tax collections have soared, this change alone helped North Carolina increase its surplus from $1.5 billion in February 2020 to more than $5.0 billion in February 2021.

Conclusion

North Carolina’s spending restraint over the past decade has yielded many significant benefits. It made tax reform and savings possible even as spending on schools and Medicaid increased. The economy has accelerated and more people are moving to North Carolina in search of opportunity. A constitutional Taxpayer Bill of Rights that holds future legislators to the same standard as legislators have voluntarily applied to state budgets since FY 2011-12 would help ensure government remains on a fiscally sustainable path with few constraints on economic growth.