- North Carolina’s labor market has largely recovered from Covid lockdowns, but there is still room for improvement

- The unemployment rate is slightly below pre-Covid levels (3.8 percent) at 3.5 percent

- Labor force participation is still below pre-Covid levels (61.5 percent), which is cause for concern

While most North Carolinians were preparing for the festivities of Christmas, the North Carolina Department of Commerce (DOC) was hard at work preparing an early Christmas gift: the November jobs report.

Every month, the DOC releases information about the state’s economy from the previous month and gives a picture of economic health indicators such as Total Nonfarm Jobs, Unemployment Rate, Labor Force Participation Rate, and other jobs-related statistics.

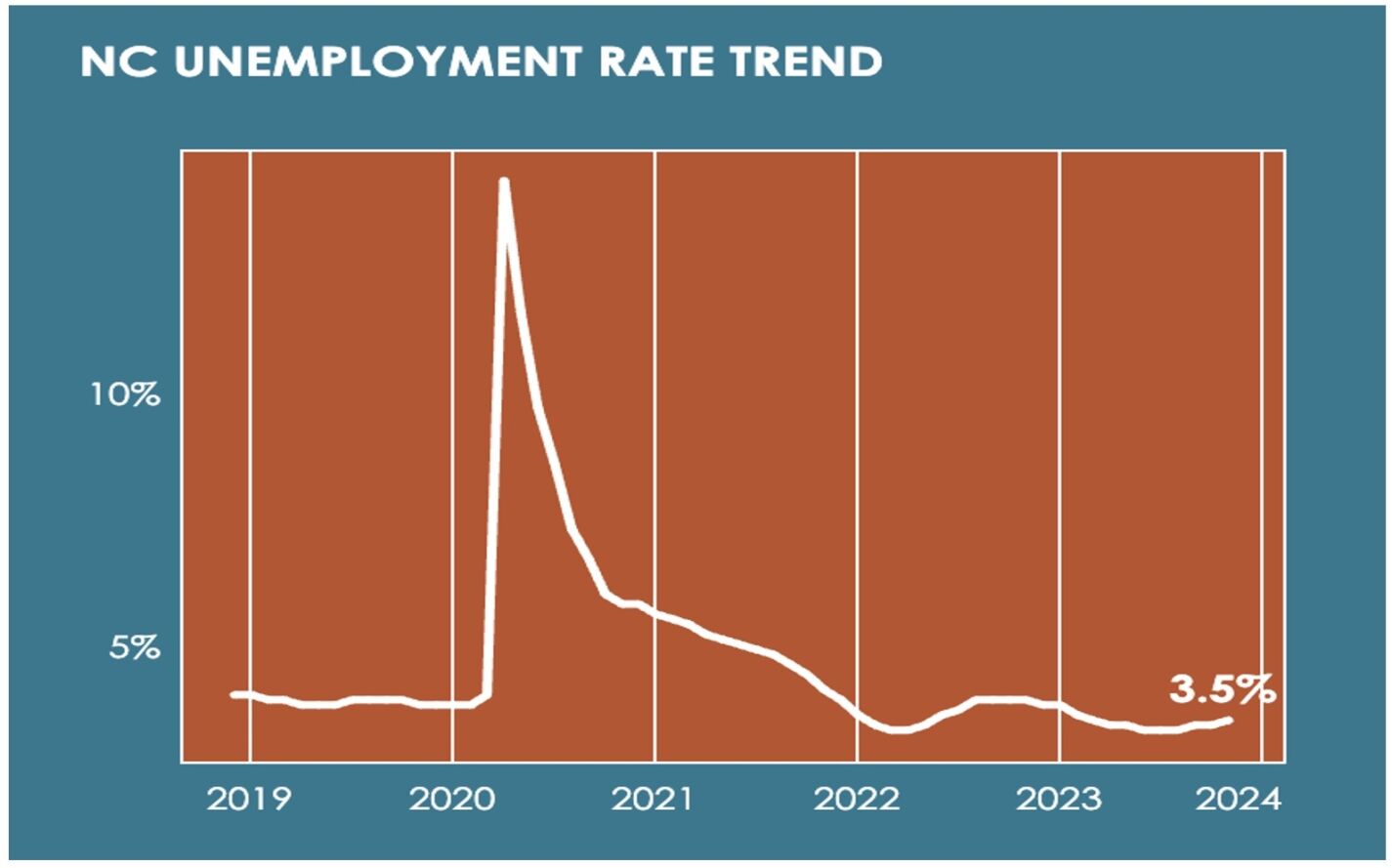

The general message from November’s report is that North Carolina’s labor market is overall relatively strong, with some caveats. Perhaps the most recognizable statistic, the unemployment rate, clocked in at 3.5 percent; it slightly beat the federal rate of 3.7 percent. Fortunately, the current rate signifies a return to and improvement upon pre-Covid levels. The November 2019 rate, shortly before Covid, was 3.8 percent — a far cry from the 14.2 percent at the height of the pandemic, in April of 2020.

Unemployment Rate, North Carolina, 2019–23

Source: North Carolina Department of Commerce

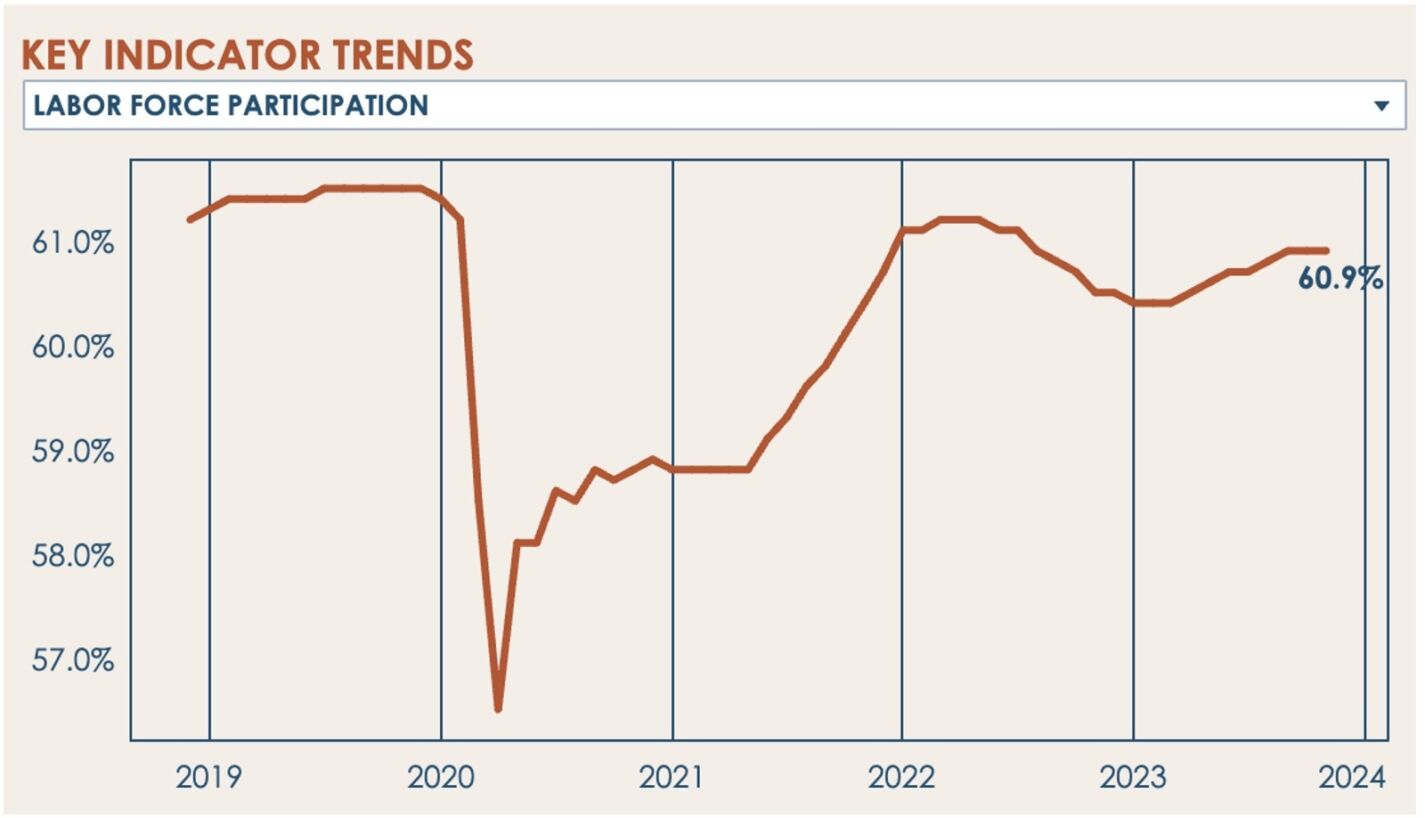

However, alongside the unemployment rate was an arguably more important number: the Labor Force Participation Rate (LFPR), which some consider the better metric for gauging the health of a labor market than the unemployment rate. The key difference is that the unemployment rate is the percentage of the “labor force” who are actively working or searching for a job but do not have one, with the labor force consisting of the employed and those unemployed actively searching for work. In contrast, the labor force participation rate is the percentage of the population in the labor force.

So the unemployment rate doesn’t capture those who were looking for work but gave up — thus missing out on a portion of the population, arguably making the LFPR a more complete measure.

For November 2023, the LFPR was 60.9 percent. The rate has remained relatively stable: November 2022 reported 60.5 percent, and November 2021, 60.7 percent. It has been (largely) recovering since the pandemic but has not reached the prepandemic level of 61.5 percent reported in November 2019. North Carolina’s LFPR was actually slightly lower than the average U.S. participation rate: the national average for November 2023 was 62.8 percent and for November 2019 was 63.3 percent. The state’s participation rate has consistently been below the national average for at least the past four years.

Labor Force Participation Rate, North Carolina, 2019–23

Source: North Carolina Department of Commerce

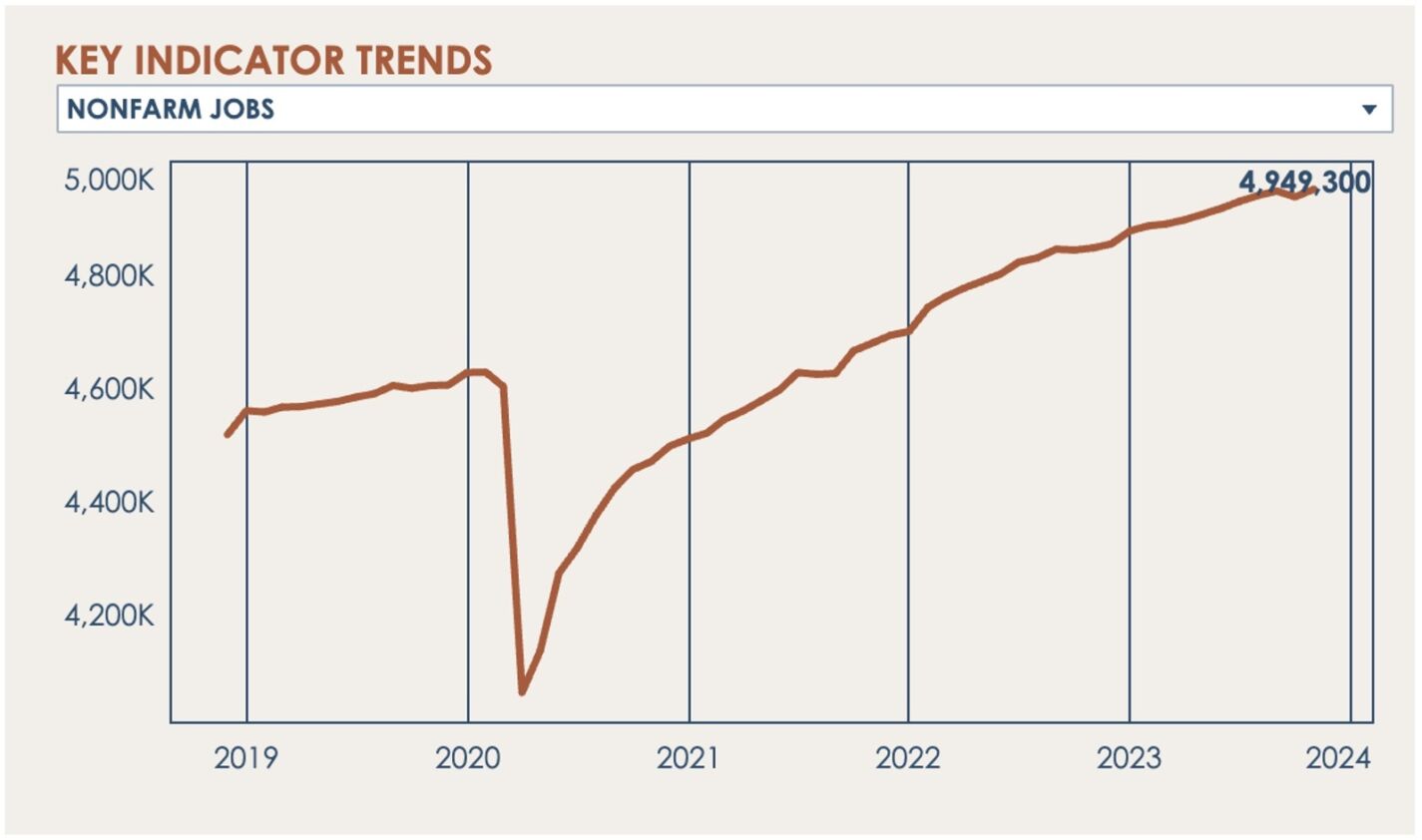

Despite the lower participation rate, nonfarm jobs (the total number of jobs in the state, excluding farm-related jobs) totaled 4,949,300, which also continued the trend of strong job growth. It previously was 4,846,000 in November 2022 and 4,677,000 in November 2021. The current findings for nonfarm jobs beat prepandemic numbers. February 2020 reported 4,626,000 nonfarm jobs. It coincides with an overall improvement in North Carolina’s economy and is a sign of North Carolina’s strong economic growth compared with the rest of the nation.

One interesting contrast to note, however, is that the above figures are taken from what’s known as the “payroll survey,” which tallies the number of employed based on a survey of business payroll numbers. The “household survey,” which contacts and totals the number of individuals reporting that they are employed, showed a slightly different trend. While the payroll survey mentioned above showed just over 272,000 new jobs in North Carolina over the past two years, the household survey showed an increase of just about 240,000. Payrolls were therefore showing a growth of more than 30,000 jobs compared with the household survey, which suggests that tens of thousands of North Carolinians were needing to take second jobs. Someone with two jobs will show up on two different payrolls but be counted only once in the household survey as an employed person.

Indeed, nationally the December jobs report showed part-time jobs reaching an all-time high as the country lost 1.5 million full-time jobs.

Total Nonfarm Jobs, North Carolina, 2019–23

Source: North Carolina Department of Commerce

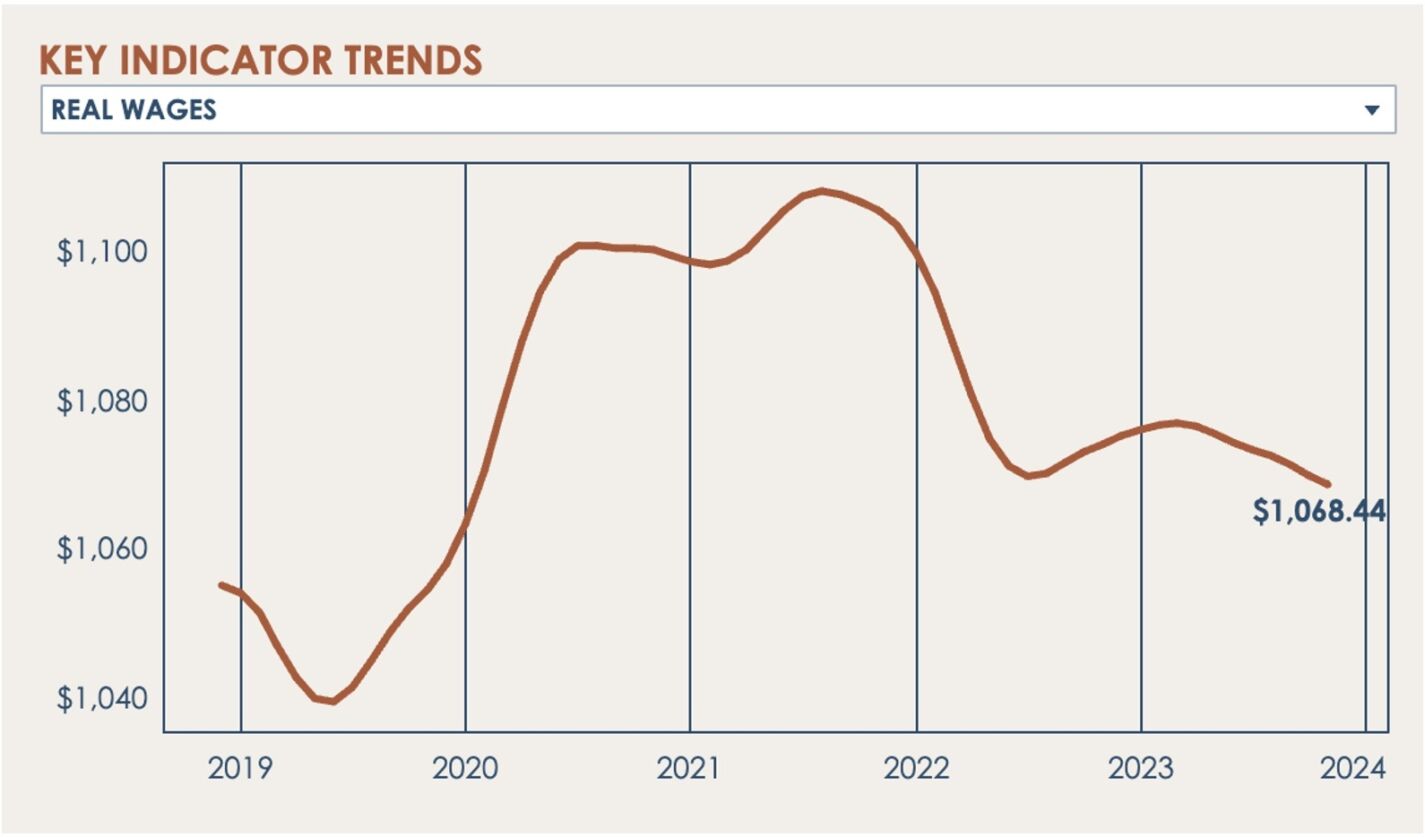

Perhaps the most troubling number from the November report is that real weekly wages were down and have been for the past several years. Real weekly wages, which are adjusted for inflation, have varied widely over the past couple years. November 2023’s average real weekly wage was $1,068.44, while November 2022’s was $1,073.87 and November 2021’s, $1,105.36. Prepandemic, real weekly wages were $1,070.40 in February 2020. What it means is that the average North Carolina worker is now financially worse off than nearly four years ago, before Covid.

Given the alarming rate of inflation we have seen since Covid-era stimulus — with annual inflation rates of 3.6 percent in 2021, 6.2 percent in 2022, and 4.9 percent in 2023, compared with a historical average of roughly 2 percent — the reduction in real wages is unsurprising.

Real Weekly Wages, North Carolina, 2019-23

Source: North Carolina Department of Commerce

In spite of this reduction in real weekly wages, the number of manufacturing hours worked has stayed relatively level. It is trending the wrong direction, however: November 2023 was 39.8 hours; November 2022, 40.2; and November 2021, also 40.2. Most of the 17 months prior to the Covid shutdowns in March 2020, average construction hours worked hovered at or above 40, according to the report.

Overall, North Carolina’s economy is holding strong, but as with the rest of the nation, it is still feeling the lingering effects of inflation and a depressed economy from the pandemic and the policy responses to it. And beneath the headline numbers, cracks are showing in the labor market data.

Many are warning of rough economic headwinds in 2024, but thanks to tax cuts, fiscal responsibility, and regulatory reform, North Carolina is better positioned than most.