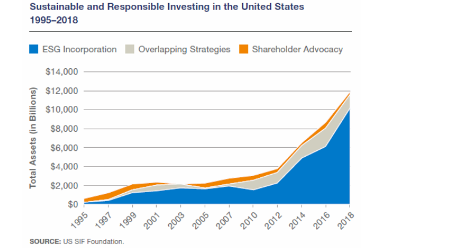

In recent years, “wokeness” has invaded a place one would least expect it, the financial industry. There has been a rise in a type of investing known as ESG, which stands for Environmental, Social, and Governance standards. ESG investing is becoming increasingly prevalent as some investors seek to bolster their reputations by supporting companies that seem to be environmentally friendly, socially responsible, and well-governed. The figure below shows the massive growth in ESG investing over the years.

However, ESG investing has no set standards, and what one investor may see as an ESG investment, another may not. In addition, companies can easily cheat the system to make it seem like they are ESG-friendly. In an attempt to create more transparency and comparability around “woke” investing, the SEC last year proposed that all publicly traded companies disclose strict climate-related information in their public filings.

While the SEC proposal may not be a big deal to large, publicly traded companies, it would be a very big deal to smaller farmers. This is because the proposed provision would require publicly traded companies to disclose the environmental standards of all private companies they work with, including farms.

Small agricultural businesses would struggle to keep up with the ESG standards that larger agricultural businesses could afford to meet. Small farms are already at a significant disadvantage due to a lack of resources, economies of scale, and access to financial resources necessary to invest in expensive sustainable practices and technologies.

There are ways for small agricultural businesses to keep up with ESG standards if they choose. One approach is to participate in ESG certification programs or partner with larger agricultural businesses that have the capital and capacity to meet investor demands. However, these solutions may not be accessible or feasible for many small farmers. As a result, small farmers may be left behind, struggling to compete with larger, more financially secure agricultural businesses that can easily afford to invest in what investors deem ESG-friendly practices and technologies. This problem will most likely increase consolidation in the agriculture sector.

In conclusion, while ESG investments seem to advocates like they would promote positive change in the agriculture industry, the reality is that small agricultural businesses face significant challenges in keeping up with ESG standards. Small farmers are at risk of being left behind, or worse, bought out if environmental “woke-ism” is forced on them.