- The U.S. government printed and spent trillions of dollars in stimulus, causing record inflation

- The economy is listing from too many dollars chasing a stagnant supply of goods

- Inflation is an implicit tax on workers, harming low-income families most

Inflation is perplexing. On an individual level, it inflicts harm on consumers at no fault of their own. It presents consumers with substandard choices: shell out more money for the same goods, change your consumption basket, or forgo your purchase, for example. It eats away at workers’ paychecks and precious savings. Politically, inflation has derailed candidates, further proof that voters take it seriously. In North Carolina, voters ranked inflation as a more important problem than unemployment by a 77 to 20 margin.

So what is inflation? Simply put, inflation is the broad rise in prices and fall in the value of money. As economist Milton Friedman stated, “Inflation is always and everywhere a monetary phenomenon.” It is not a fiscal phenomenon, related to government taxes or budgets. Friedman continued, saying inflation “can be produced only by a more rapid increase in the quantity of money than in output.”

The current bout of inflation stems from massive spending: in 2020 and 2021, the government spent the equivalent of 27% of GDP on “Covid relief” and “stimulus,” the second-largest fiscal response as a percentage of GDP of any industrialized nation. And this spending was largely paid for by newly created money from the Federal Reserve.

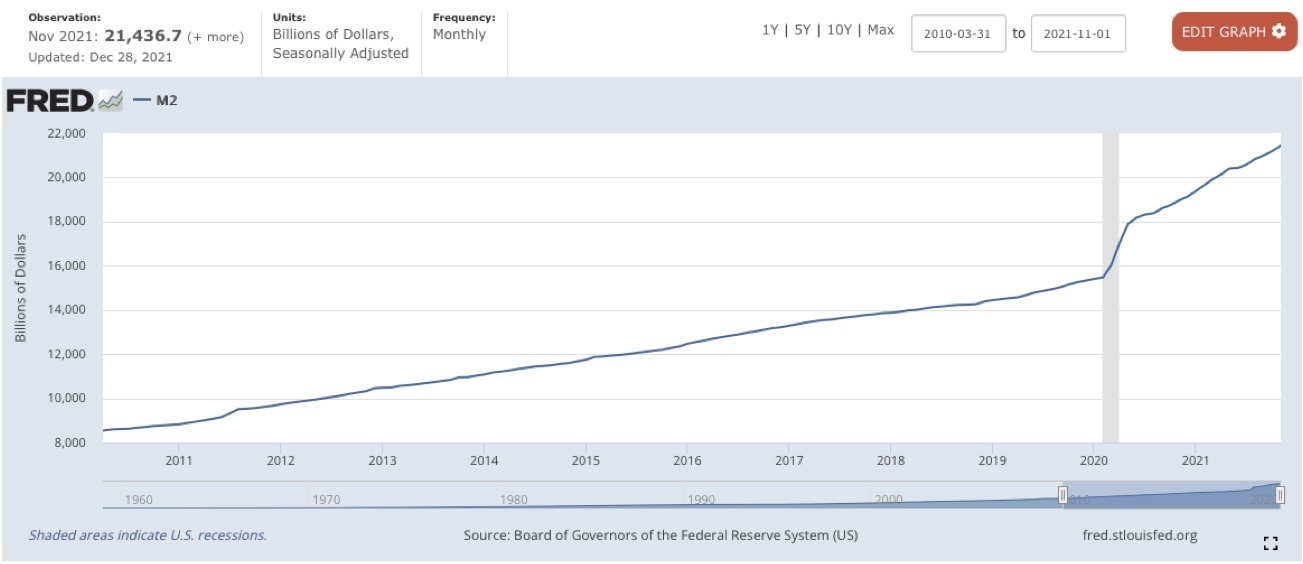

The below graph of the money supply shows the massive injection of cash since the pandemic’s onset:

In just 21 months, from February 2020 to November 2021, the money supply increased by the same amount it did in the nearly 10-year period preceding it, from July 2011 to February 2020.

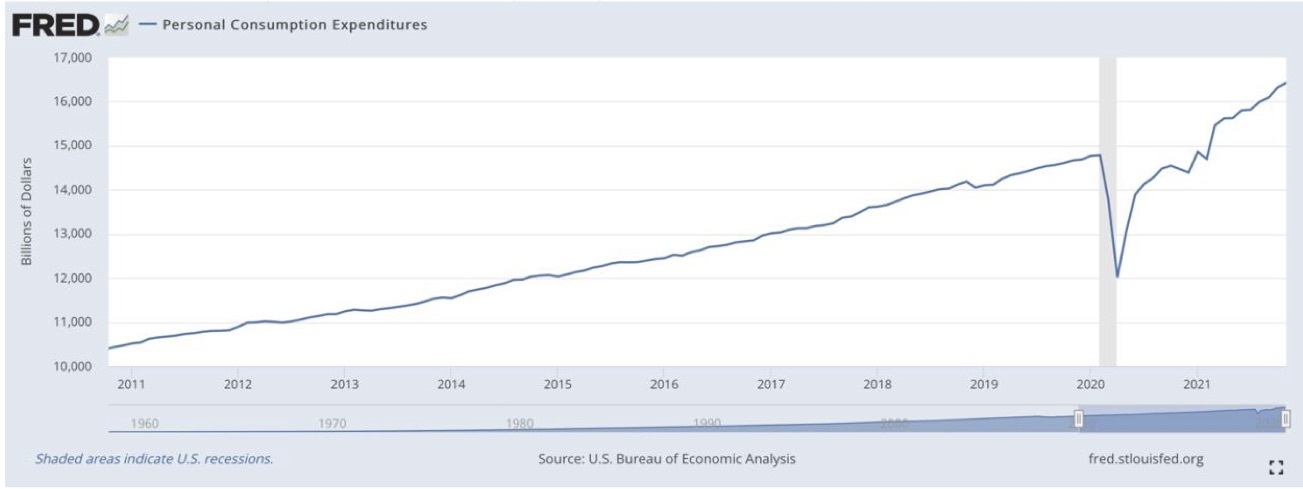

Consumers spent less money during the onset of the pandemic due to uncertainty. By March 2021, however, personal consumption exceeded pre-pandemic levels to continue long-term trends.

We are experiencing high, simulated demand propped up by trillions of newly created dollars. Supply is struggling to keep up.

Exacerbating the supply issue is the government-mandated shutdown of businesses. Shutdowns have devastated entire sectors and prompted falls in the labor force participation rate. The government also increased payments for some of the unemployed not to work — causing some wages to increase further as businesses were forced to compete for workers with a government check in certain sectors. Overall, however, wage increases have not kept pace with inflation.

While government programs did lend a hand to some in need (businesses via the Paycheck Protection Program loans, for example), much of the “relief” spending was wasted. According to The Heritage Foundation, less than 10% of the $1.9 trillion “American Rescue Plan” Act for Covid relief addressed public health.

Now, consumer and producer prices are climbing at record highs. According to the latest data, wholesale prices have risen 9.7% since last year. Consumer prices have risen 7% since last year, a 39-year high. Six of the last nine months have seen CPI increases of at least 0.5%. The value of your dollars is being eaten away by a rising cost of living.

Trillions in government spending resulted in an economy bloated with cheap money. Due to the dramatic spending and the countless downstream effects of the reactions to the pandemic, solutions to inflation are neither quick nor straightforward. In recent weeks, the Federal Reserve announced they expect to raise interest rates three times in 2022 to cool inflation. Yet with an economy propped up and addicted to cheap money, doing so could deal a heavy blow to the economy overall. Moreover, the massive national debt would become much more expensive to service with higher interest rates.

Unfortunately, leaders in the White House have offered bogus solutions, often scapegoating an undeserving third party. Throughout the end of last year, the Biden Administration claimed the “Build Back Better” Act would help ease inflation by making life less expensive for working people — at zero cost. How spending trillions more in newly created dollars would actually fight inflation went unexplained.

Another fanciful solution the White House offers is to utilize antitrust to disarm the big companies (that were big long before this inflation) that are supposedly responsible for price spikes. The Biden administration even blames port delays and the supply chain crisis as an inflation driver. While these supply chain issues harm an already weak supply, they are not the reason for inflation, which is defined as a sustained rise in prices overall, not just in specific sectors. These strategies have more to do with advancing the Biden agenda than alleviating inflation.

While leaders quibble over solutions, inflation continues to harm American families. Low-income workers, retirees, and individuals on fixed incomes are harmed most as they cannot keep up with inflation’s pressures. Inflation’s effect is like a hidden tax, which hits them especially hard. They have little room to change their consumption habits as most of their income is already being spent on necessities.

America needs leaders who will acknowledge the real dangers of inflation. For the rich, inflation is but a minor inconvenience, but for working class and low-income households inflation poses a serious threat to their household budgets. Callously creating inflation to get pet projects through Congress snubs those who are hurting most.