It’s time to recognize that earning a living in North Carolina is a right, not a privilege. Thankfully, North Carolina senators introduced a bill last week to repeal the redundant and antiquated privilege license tax, which requires certain professionals who need a state license to pay an annual amount to the state. This tax burdens workers with added costs and a complicated compliance process.

From a revenue standpoint, the privilege license tax revenue is negligible. The majority of revenue from this tax comes from installment paper dealer fees. Excluding those fees, the privilege license fees brought in a mere $6.6 million in FY 2021.

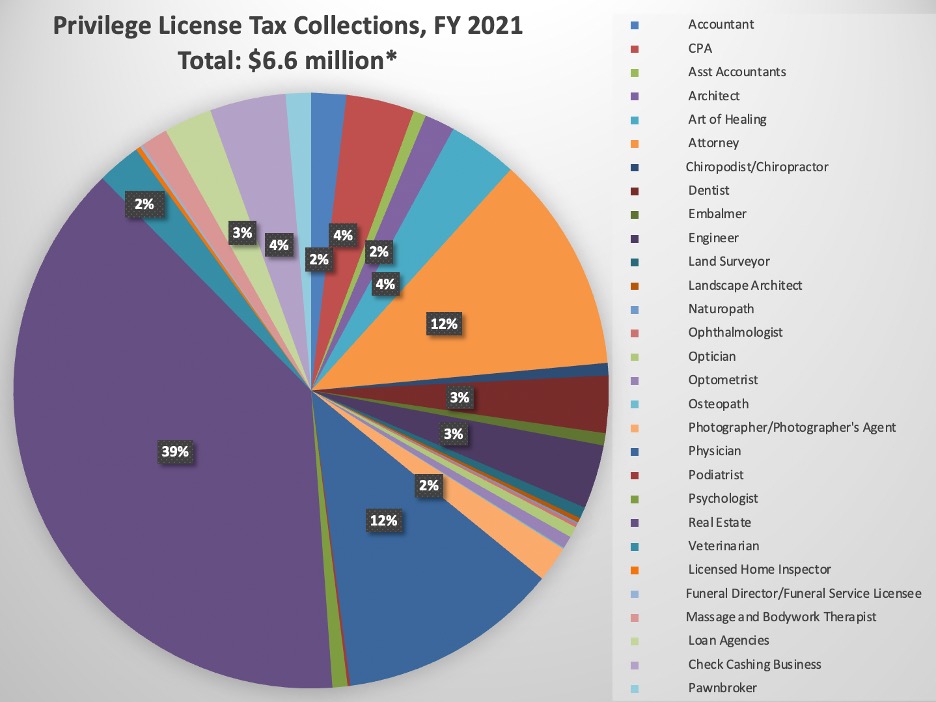

Not all occupations must pay a privilege license tax. Rather, the tax is currently levied on a random patchwork of occupations. See the below chart for some examples. The bill introduced in the NC Senate last week would eliminate the privilege license tax on these occupations, but not the installment paper dealers. I wrote previously, the real estate sector pays the largest share: 39% of the $6.6 million total for FY 2021. The North Carolina Department of Revenue (DOR) processed more than 53,000 licensees or renewals for real estate agents in North Carolina in FY 2021. Physicians were the second largest group, with more than 16,000 licenses.

Source: Collections information for privilege licenses processed during 2020-21 received in email correspondence with the North Carolina Department of Revenue

Though the annual fee itself is relatively small, the compliance process is both wonky and time-consuming. The privilege license tax cannot be paid online or even over the phone. Individuals or businesses must pay the recurring annual fees through “snail mail.” This is an unnecessary compliance cost for workers. It also burdens DOR with added compliance and monitoring.

North Carolina is a model for pro-growth tax reform that has continually allowed North Carolinians to keep more of their hard-earned money. Eliminating the privilege license tax is another way to put North Carolina workers first.